NVIDIA Corporation's EPS is $3.42, based on its full-year outlook for fiscal 2023, falling from $4.44 in January 2022.

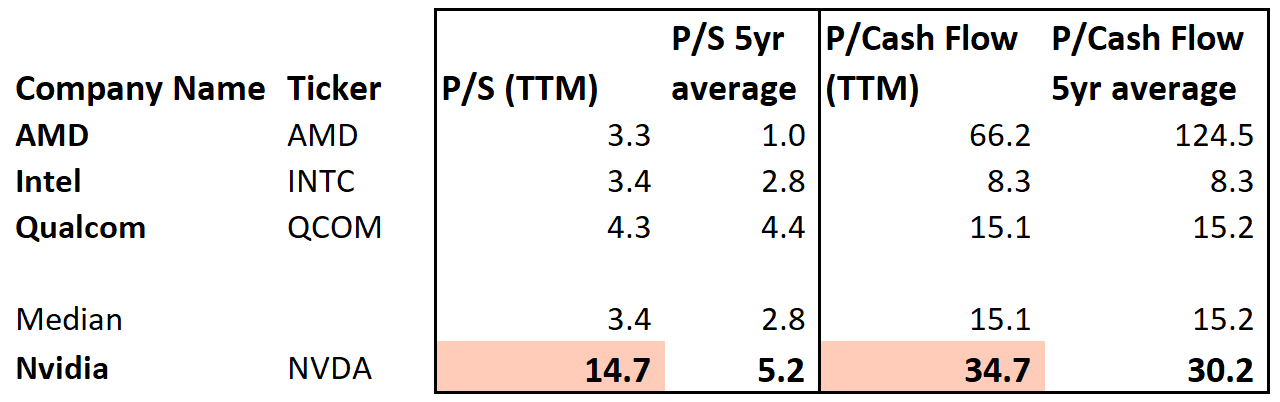

This metric is calculated as net income (after dividends on preferred stock) divided by the number of outstanding shares. NVIDIA Corporation's stock by the numbersįirst of all, let's look at EPS, which indicates how profitable a company is on a 'per share' basis. What do NVIDIA Corporation’s fundamentals tell us about the investment opportunity? Let's have a look. There are potentially dozens of fundamental metrics to analyze, but we like to focus on are price to earnings ratio ( P/E ratio), earnings per share ( EPS), price-to-sales ratio (P/S ratio) and debt. They are a set of key metrics that, when looked at holistically, can tell us whether or not a company is likely to be a good investment over the long term. Investors have relied on fundamentals for decades to assess the financial health of an organization as well as its growth prospects.

Why are fundamentals important?Īnalyzing a company’s fundamentals gives us key insights into whether or not the company will be a good long-term investment. Year-to-date (YTD), the stock is down by 56%.īut is NVIDIA Corporation worth considering as a long-term investment? Let’s take a look at the company’s outlook based on the most recent financial data to see if we can get any insights. NVIDIA Corporation's stock is trading at $132 as of Oct 6, 2022. The company makes some of the best graphics cards in the world, powering everything from gaming and crypto mining to artificial intelligence (AI). The company was founded in 1993 and is headquartered in Santa Clara, CA.

( NASDAQ: NVDA) engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software.

0 kommentar(er)

0 kommentar(er)